What it means: COVID-19 Deferral of Employee FICA Tax

Por um escritor misterioso

Descrição

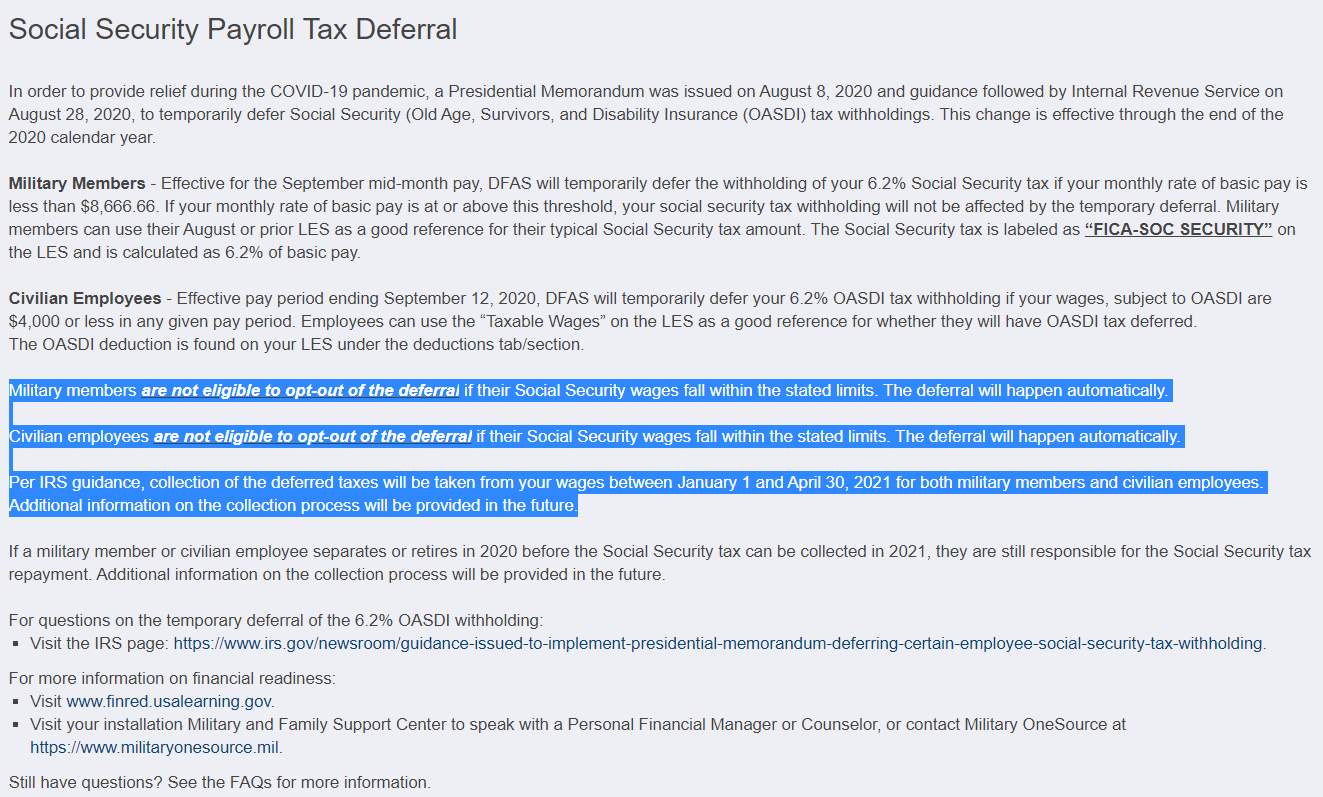

On August 8, 2020, President Trump signed an Executive Order Deferring Employee FICA Taxes. We’ve put together a guide clarifying what the order means and who it applies to.

Maximum Deferral of Self-Employment Tax Payments

Here's what Trump's executive order deferring payroll taxes means for workers

IRS clarifies Social Security tax deferral under CARES Act

Heads Up – Deferred FICA Tax Due Soon - AccuPay, Payroll and Tax Services

Rep. Don Beyer on X: NEW: over Labor Day weekend the Trump Administration quietly confirmed it will subject the entire United States military to Trump's payroll tax scheme. They wrote: military members

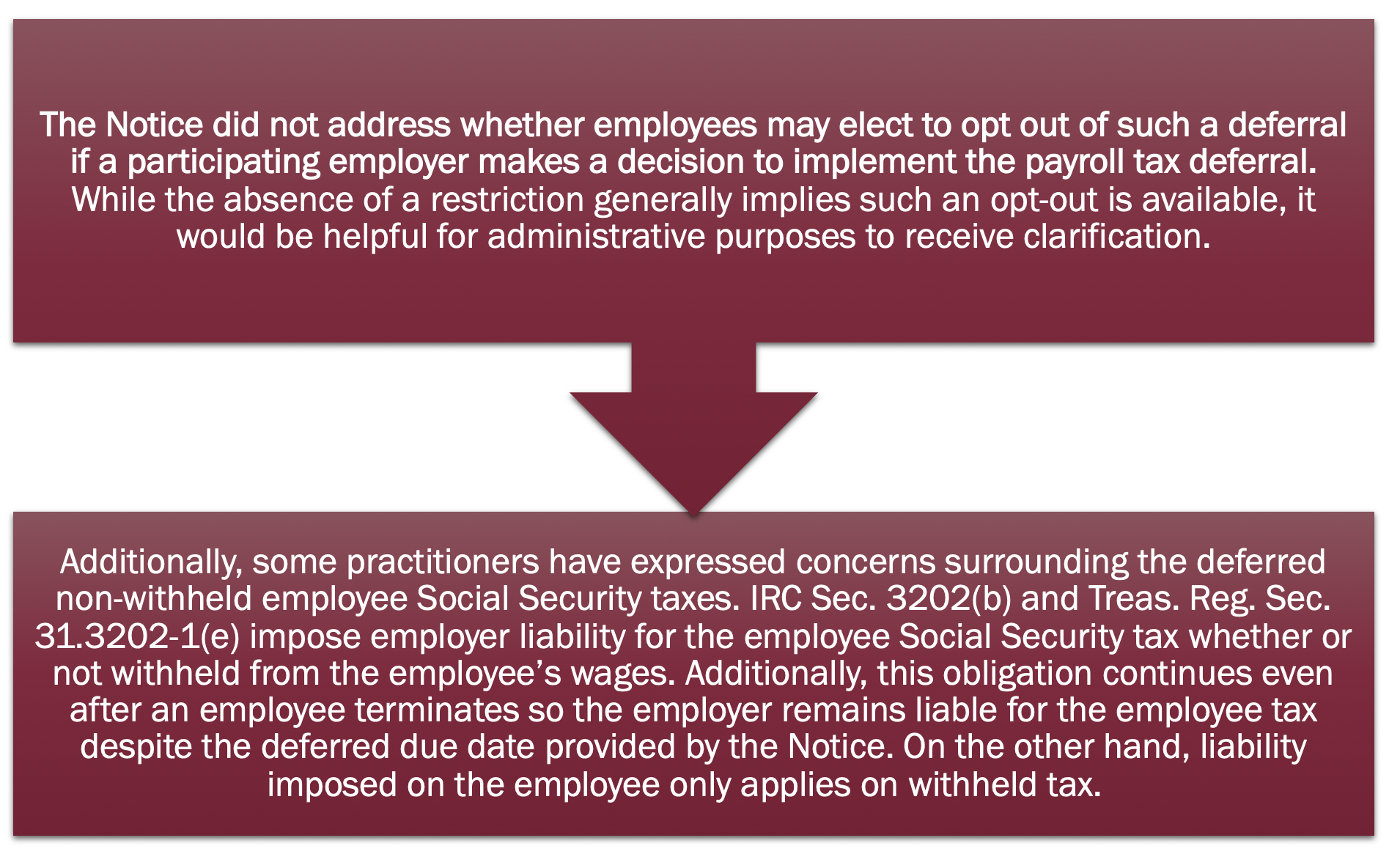

The President's action to defer payroll taxes: What does it mean for your business? — Fenner Melstrom & Dooling, PLC

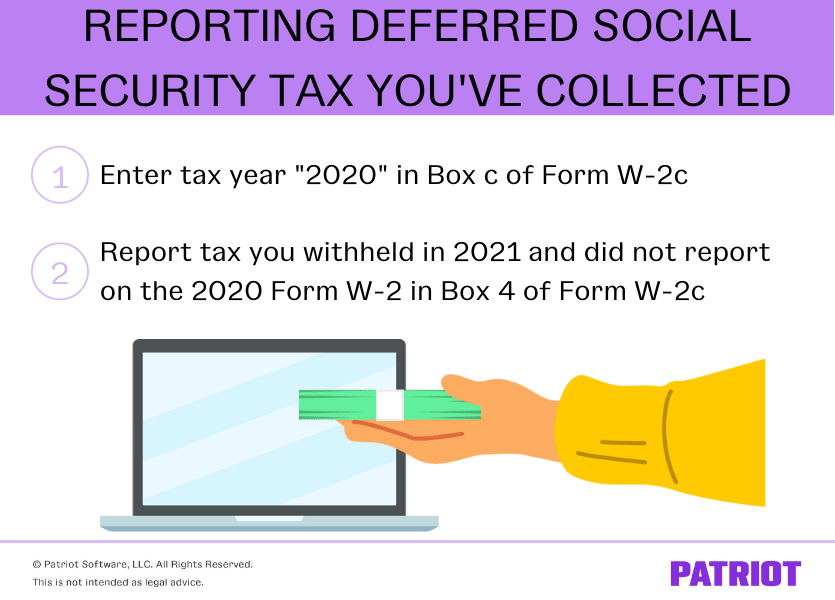

Final Instructions For Payroll Tax Form For COVID-19 Relief

Navy Reserve - NAVADMIN 252/20 explains the temporary

Implementing SAP US Payroll Executive Order for Social Security Tax Deferral

Reporting COVID Pay on W-2 2021

DEFERRED SOCIAL SECURITY TAX PAYMENT DUE DECEMBER 31 FOR PARTICIPATING EMPLOYERS, SELF-EMPLOYED PEOPLE

COVID-19 Payroll Tax Relief Raises Questions — Zenith American Solutions Blog

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:quality(85):extract_cover()/2015/11/15/262/n/1922398/0d5af2484110be2b_RE303a_0336b.jpg)