Solved According to the CAPM, overpriced securities should

Por um escritor misterioso

Descrição

Answer to Solved According to the CAPM, overpriced securities should

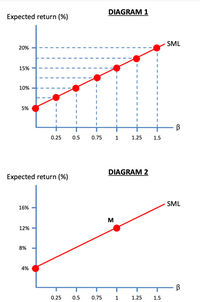

Answered: This question relates to Diagram 2 from…

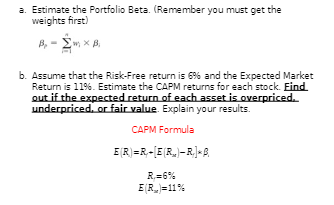

Answered: a. Estimate the Portfolio Beta.…

Security Expected Return Estimated Return A: Capital Asset Pricing Model ( CAPM), PDF, Capital Asset Pricing Model

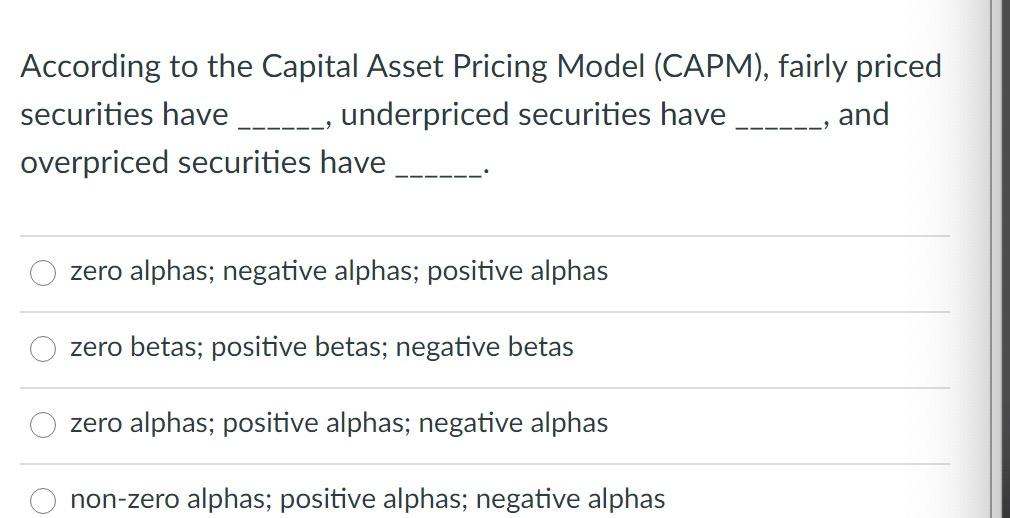

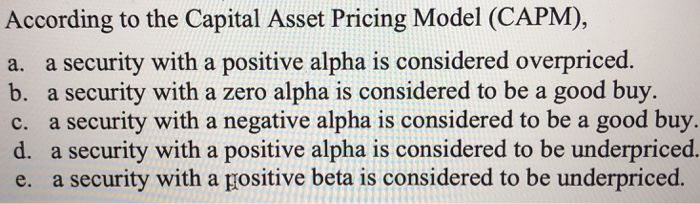

SOLVED: According to the CAPM, overpriced securities should have: - Negative alphas - Positive alphas - Zero alphas - Large betas

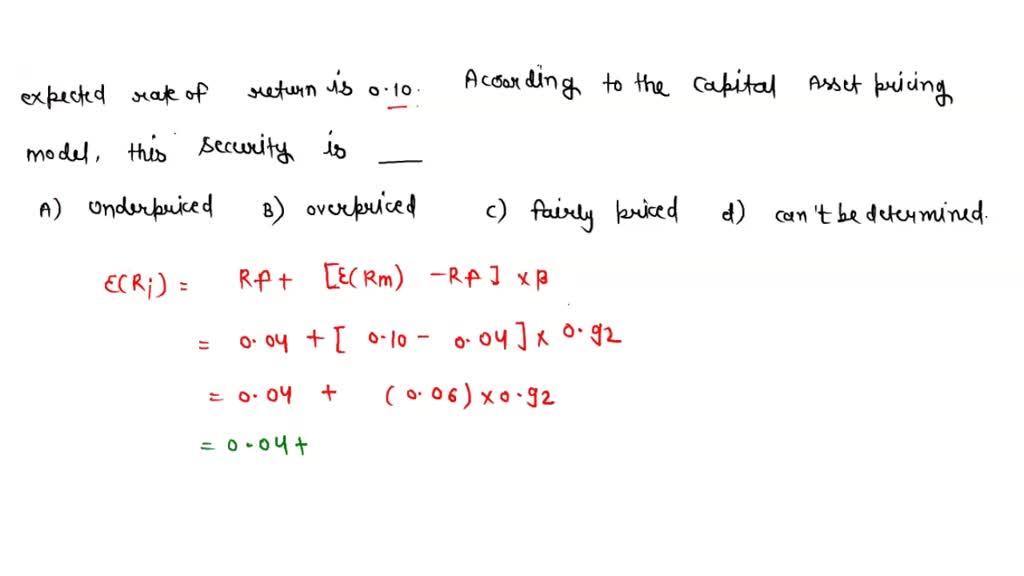

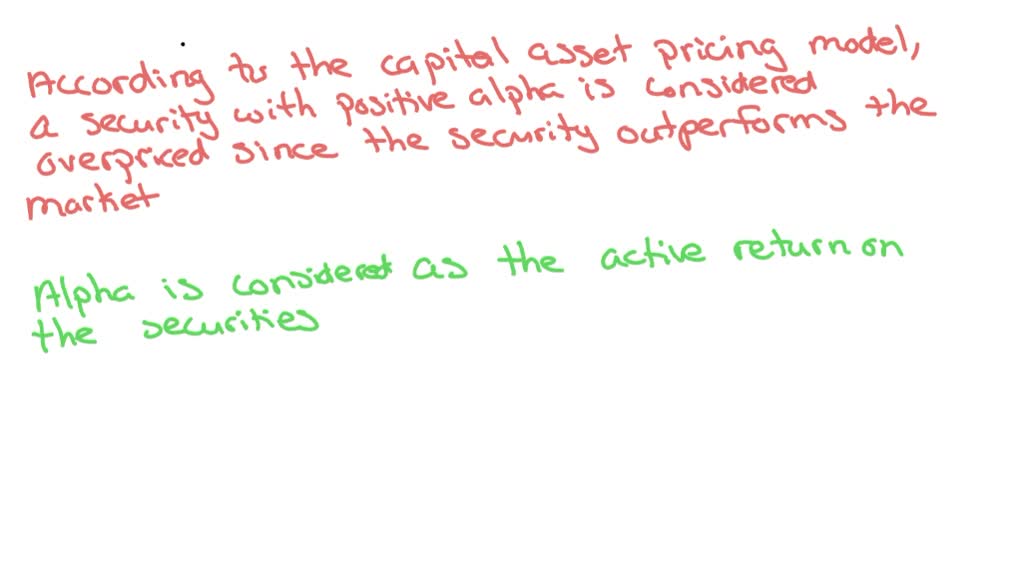

SOLVED: Your opinion is that Boeing has an expected rate of return of 0.08. It has a beta of 0.92. The risk-free rate is 0.04 and the market expected rate of return

SOLVED: Question 4 According to the Capital Asset Pricing Model (CAPM), a security with: 0 / 1 point An alpha of zero is able to generate a return which greater than the

Solved According to the Capital Asset Pricing Model (CAPM)

Solved tried googling everything and still no luck. could

:max_bytes(150000):strip_icc()/DDM_INV_CML-Final-a50f290fb65849cdab26156c236777a5.jpg)

Understanding Capital Market Line (CML) and How to Calculate It

de

por adulto (o preço varia de acordo com o tamanho do grupo)