CMBS and Commercial Real Estate Implications of a Kohl's Takeover

Por um escritor misterioso

Descrição

Key Takeaways: Kohl’s plans to open smaller stores and transition away from department store formatThe highest concentration of Kohl’s lease expirations occurs in 2024 impacting $815 million in CMBS debtCMBS exposure to Kohl’s totals approximately $5 billion Speculation surrounding Kohl’s and its future as a public company has been active during Q1 2022. In early-March

BMO Commercial Mortgage Securities LLC Form 424H Filed 2023-01-17

The E-Commerce Takeover: Why Department Stores Are Struggling This Holiday Season, by Stephanie Hughes

The Retail Crossroads - Exploring the Potential for Malls

Post-Lockdown New Normal: Many Brick & Mortar Stores Will Not Reopen, CMBS will Default, Mess to Ensue

boston - The Real Reporter

PETITION

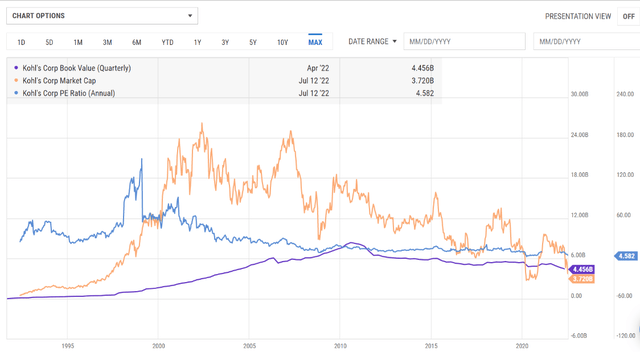

Dear Kohl's: A Lesson In Value Creation Or Value Destruction? (NYSE:KSS)

Press Release Archives - Page 2 of 10 - Mission Capital

New Lows for Luxury High Street Retail Across the US – Commercial Observer

Lock In Your Bets: 22 Commercial Real Estate Trends To Expect In 2018

Real estate's ticking bomb: Who gets hurt

5-13-16

img001_v1.jpg

de

por adulto (o preço varia de acordo com o tamanho do grupo)