Students on an F1 Visa Don't Have to Pay FICA Taxes —

Por um escritor misterioso

Descrição

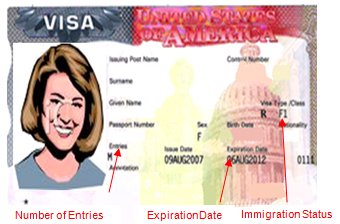

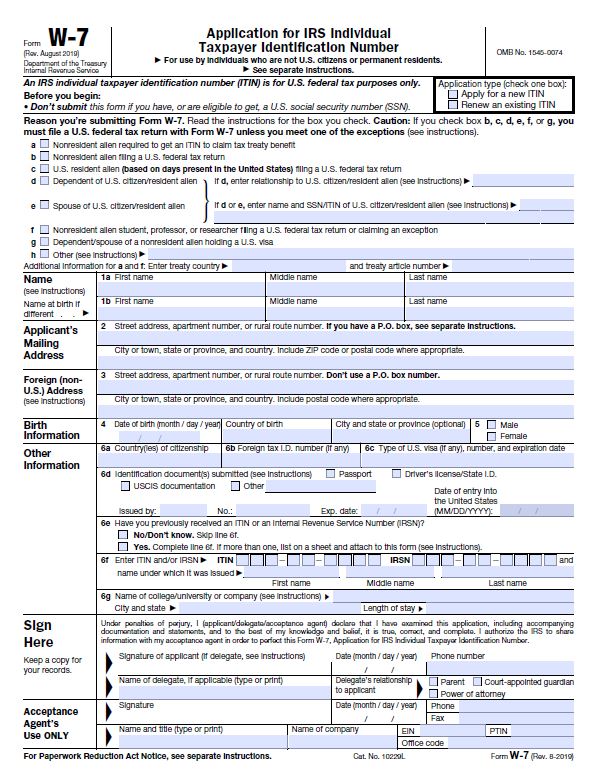

In general, non-US citizens employed in the U.S. are required to pay FICA taxes. However, those with single intent, or non-immigrant status (or F1 visa holders) are exempt from FICA taxes.

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com

Does Unpaid Tuition Affect Your Credit Score? - Experian

Sample Pay Check and FICA Taxes Savings for CPT, OPT Studetns

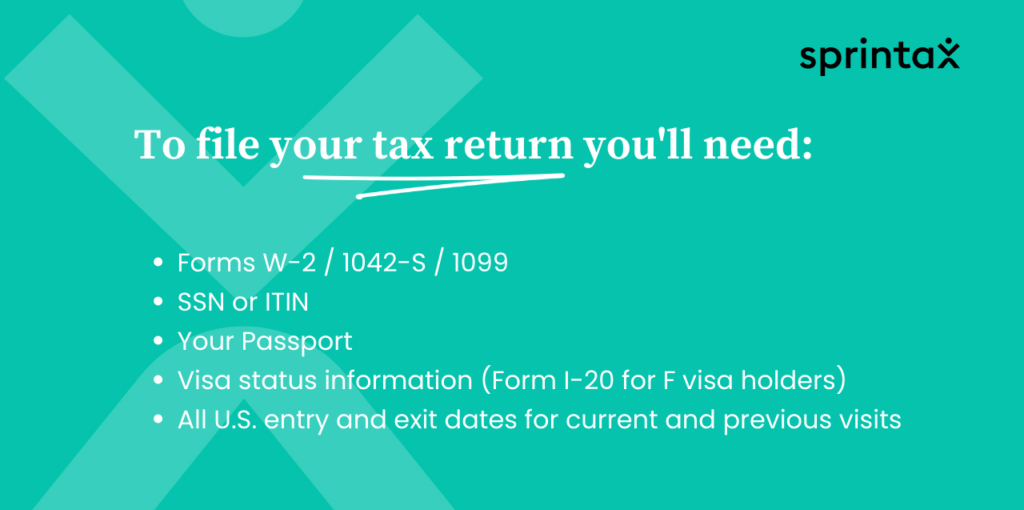

Tax Filing Support International Student and Scholar Services

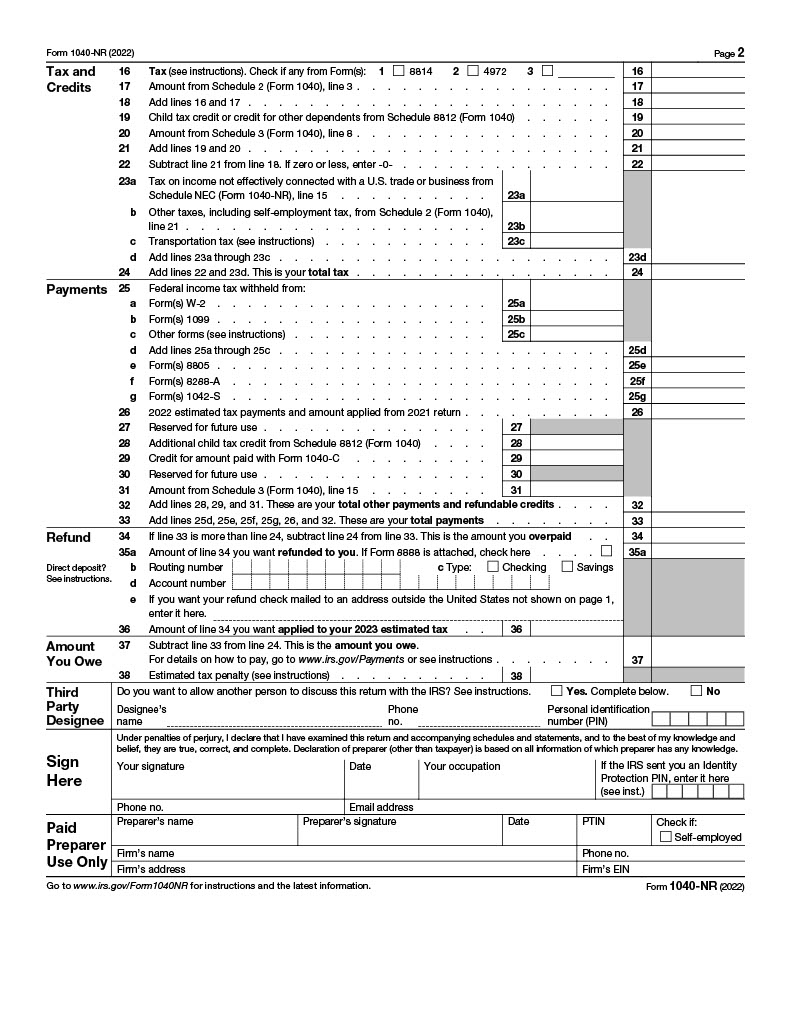

F-1 International Student Tax Return Filing - A Full Guide [2023]

F-1 visa – Office of International Students and Scholars – UMBC

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com

5 US Tax Documents Every International Student Should Know

Filing Taxes as a Non-Resident > International Student and Scholar Services

F-1 International Student Tax Return Filing - A Full Guide [2023]

The Complete J1 Student Guide to Tax in the US

What's FICA and who is exempted of FICA taxes?

Can You Opt Out of Paying Social Security Taxes?

de

por adulto (o preço varia de acordo com o tamanho do grupo)