Overview of FICA Tax- Medicare & Social Security

Por um escritor misterioso

Descrição

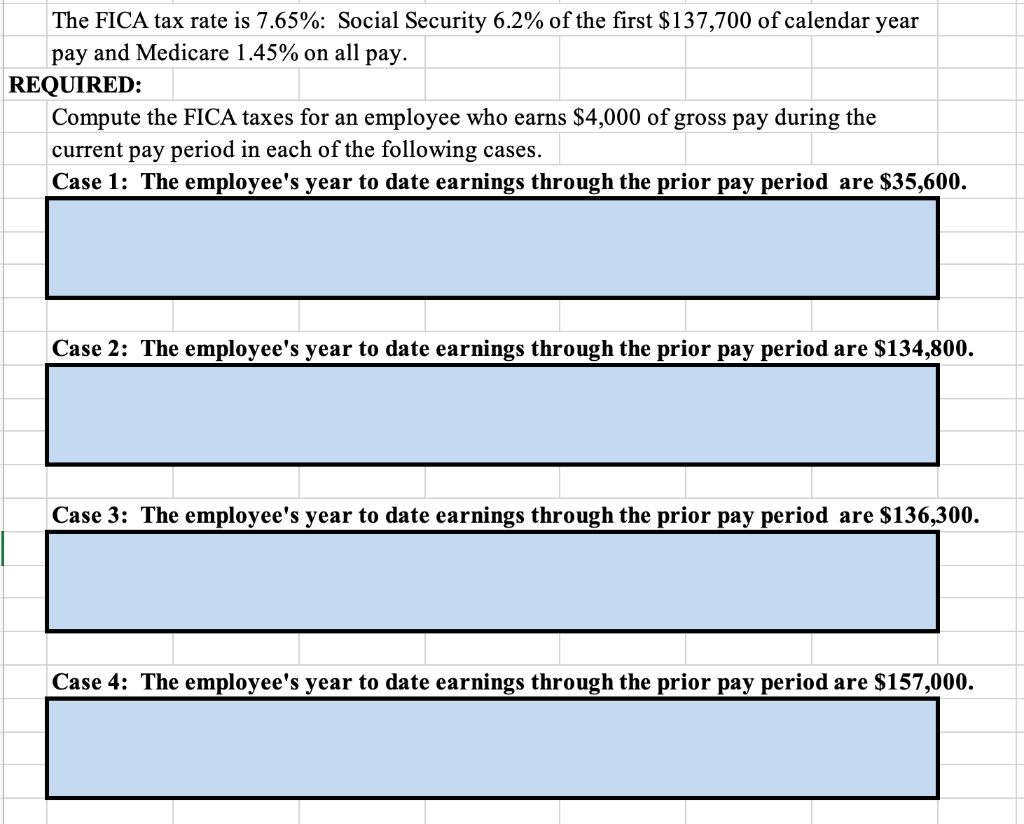

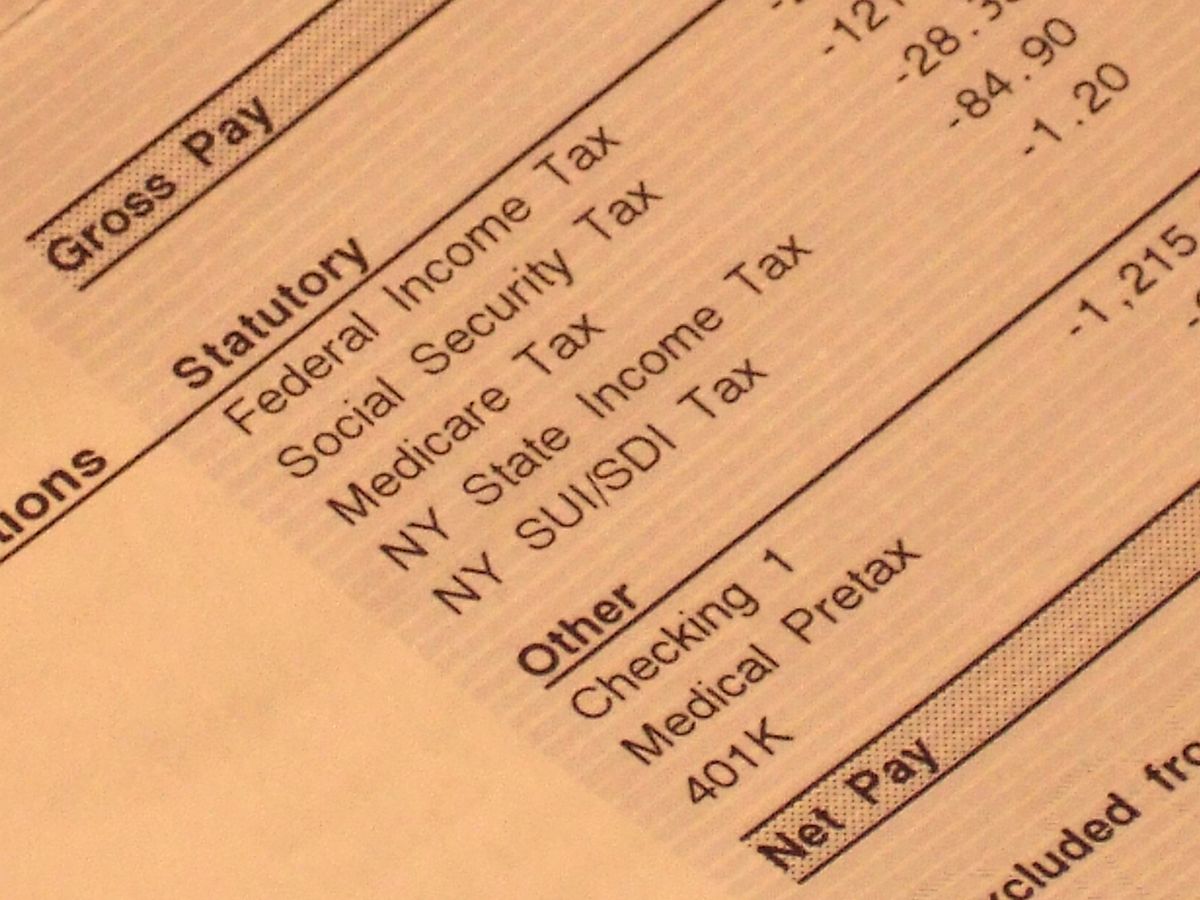

FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay. FICA Taxes are the fundamental subsidizing focal point for Social Security benefits.

Solved The FICA tax rate is 7.65%: Social Security 6.2% of

What is FICA and why does it matter for Social Security, Medicare

Historical Social Security and FICA Tax Rates for a Family of Four

Medicare Tax: Current Rate, Who Pays & Why It's Mandatory

What is FICA tax?

2020 Payroll Taxes Will Hit Higher Incomes

Employers responsibility for FICA payroll taxes

Self-employed and FICA Taxes - OSYB Number Crunch! Bookkeeping

Fixing Social Security and Medicare: Where the Parties Stand - The

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)

Federal Insurance Contributions Act (FICA): What It Is, Who Pays

Students on an F1 Visa Don't Have to Pay FICA Taxes —

de

por adulto (o preço varia de acordo com o tamanho do grupo)