Ishka: SLB returns: Unlevered IRR and NPV analysis

Por um escritor misterioso

Descrição

This data sheet is an illustrative look at net present values (NPVs), and unlevered returns (IRRs) for six hypothetical sale/leaseback (SLB) transactions informed by rumoured pricing terms of real SLB deals concluded between May and July 2023.

Ishka: Aviation Industry Reports – Aviation Finance Market Data

LOS B, Reading 28 - Corporate Issuers, CFA Level 1

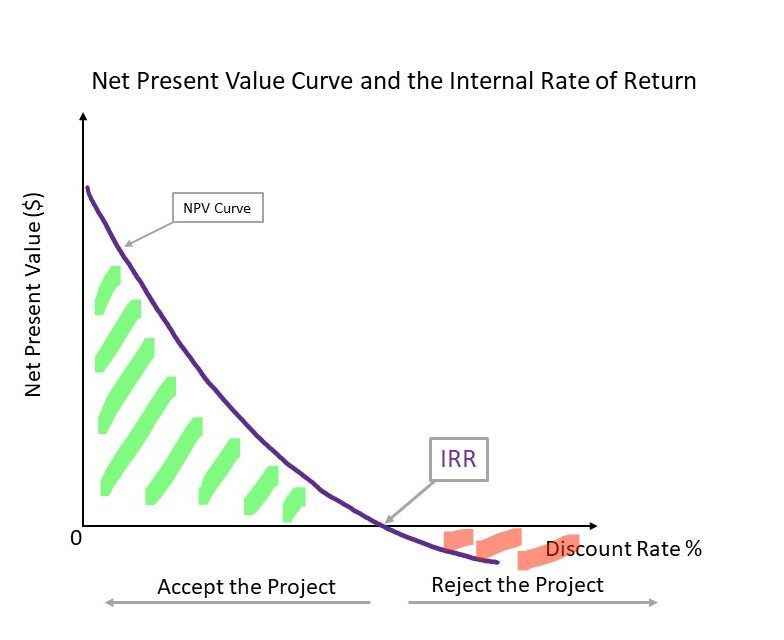

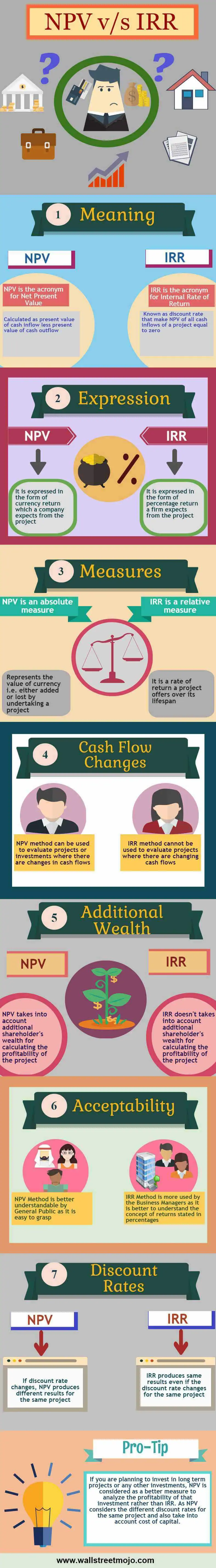

NPV vs. IRR. Which return measure should you use to evaluate your project? Probably you should use both but what are the benefits and drawbacks - Thread from Anders Liu-Lindberg @LiuLindberg

Unlevered IRR vs Levered IRR in Real Estate Investing - Willowdale Equity

Chapter 2: Decisions, Decisions, Decisions. – Social Cost Benefit Analysis and Economic Evaluation

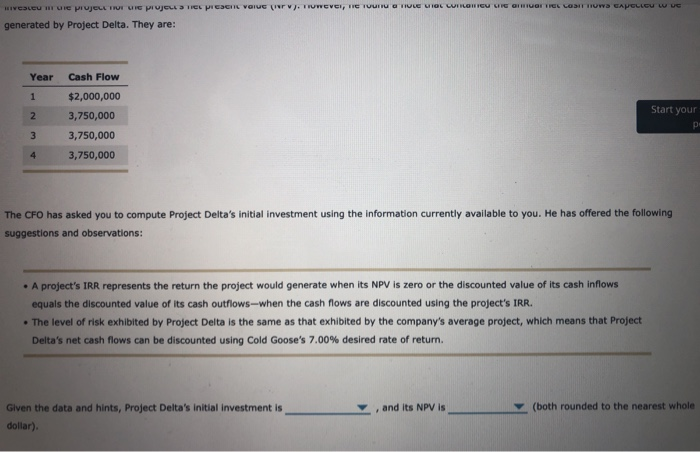

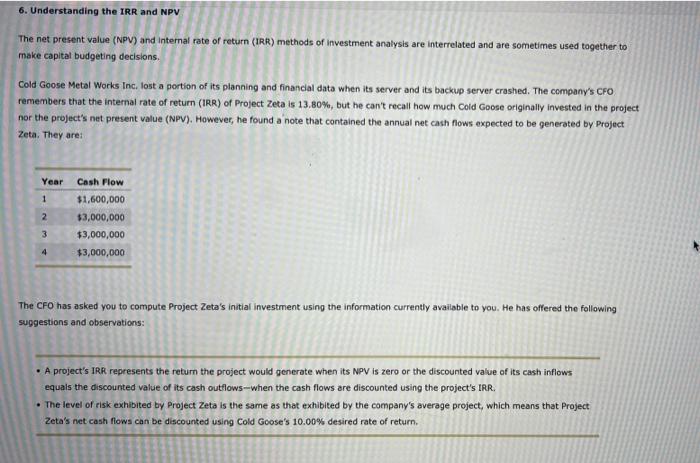

Solved 6. Understanding the IRR and NPV The net present

Solved 6. Understanding the IRR and NPV The net present

LOS B, Reading 28 - Corporate Issuers, CFA Level 1

NPV vs IRR Which Approach is Better for Project Evaluation?

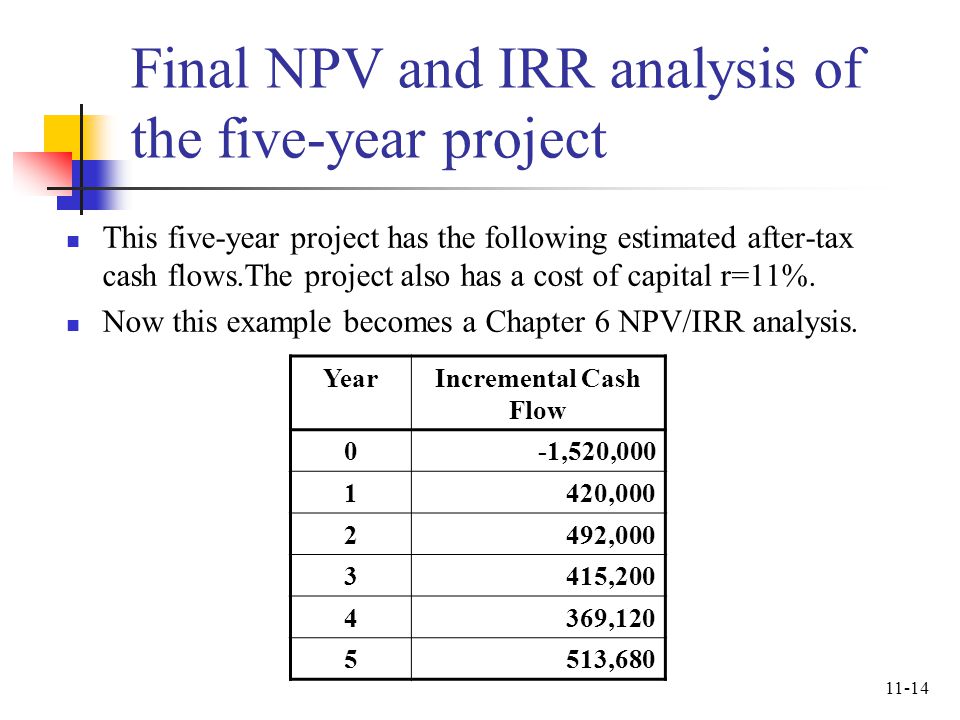

Chapter 7: Capital Budgeting Cash Flows - ppt video online download

Levered vs. Unlevered Return - Project Finance

Levered Vs Unlevered IRR Explained

de

por adulto (o preço varia de acordo com o tamanho do grupo)