Understanding FICA Taxes and Wage Base Limit

Por um escritor misterioso

Descrição

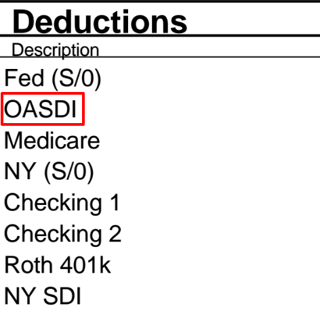

Employers deduct a certain amount from employee paychecks to pay federal income tax, Social Security tax, Medicare (Hospital Insurance) tax, and state income

Federal & Regular FICA Tax Table Maintenance (FEDM & FEDS)

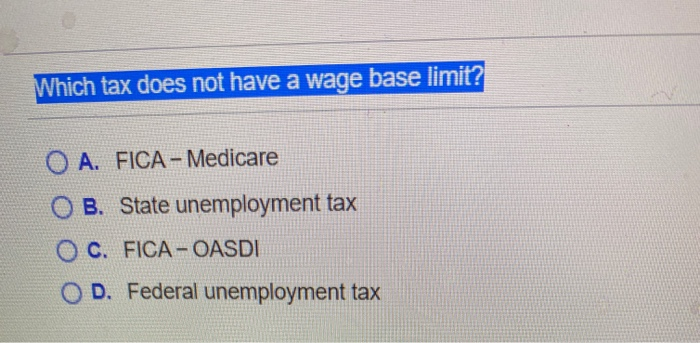

Solved Which tax does not have a wage base limit? O A. FICA

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)

Federal Insurance Contributions Act (FICA): What It Is, Who Pays

medicare tax limit 2023 –

Federal Insurance Contributions Act - Wikipedia

FICA Tax Exemption for Nonresident Aliens Explained

Solved] estion list The total wage expense for Kiln Co. was

Employers: In 2023, the Social Security Wage Base is Going Up

Social Security wage base jumps to $127,200 for 2017

de

por adulto (o preço varia de acordo com o tamanho do grupo)