Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

Por um escritor misterioso

Descrição

An underpayment penalty is an IRS fee for failing to pay enough of your total tax liability during the year. Here’s how to determine if you owe an underpayment penalty.

:max_bytes(150000):strip_icc()/Term-Definitions_Underpayment-penalty-Resized-7d6a14e797ad4b1584b7f659fff3a568.jpg)

Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

Use These 3 Tips to Avoid Estimated Tax Penalties - SH Block Tax Services

Safe Harbor for Underpaying Estimated Tax

Diversified Strategies Financial Services, Inc.

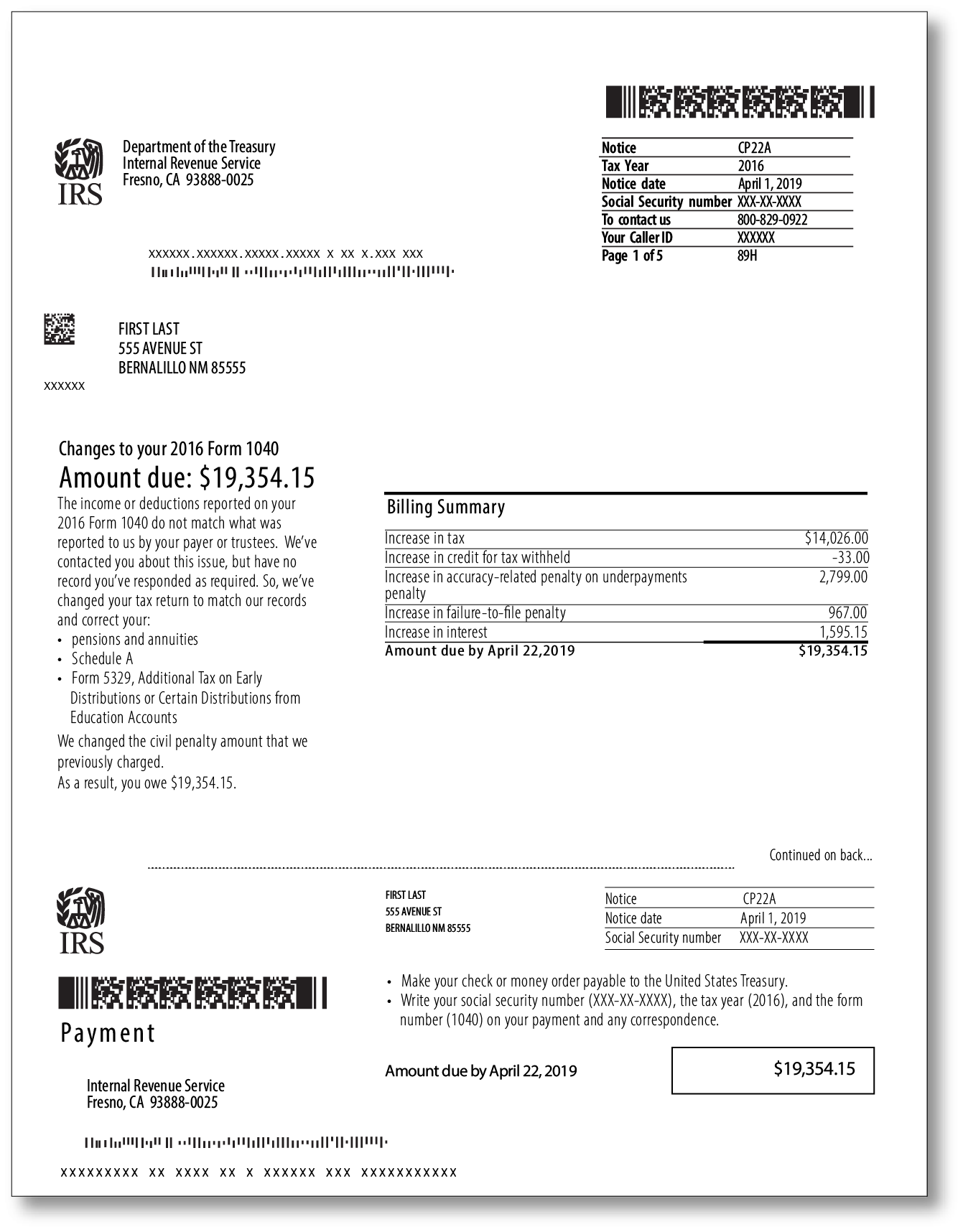

TaxAudit Blog, You got a CP22A

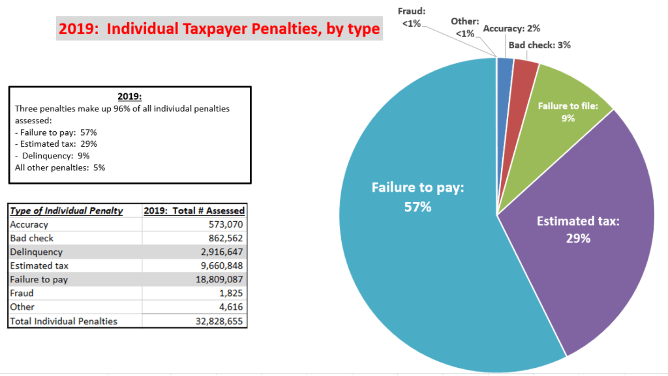

Penalty for Underpayment of Estimated Tax

IRS Penalty and Interest Calculator, 20/20 Tax Resolution

Underpayment Penalties - FasterCapital

What is IRS Form 2210? - TaxFAQs

Estimated Tax Penalty: The Correct Way to Make Estimated Tax Payments for 2021

How To Make Quarterly Estimated Tax Payments For Ministers - The Pastor's Wallet

Do's and Don'ts When Requesting IRS Penalty Abatement - Jackson Hewitt

de

por adulto (o preço varia de acordo com o tamanho do grupo)