FICA refund for F1 visa / OPT / CPT students – 1040NRA.com

Por um escritor misterioso

Descrição

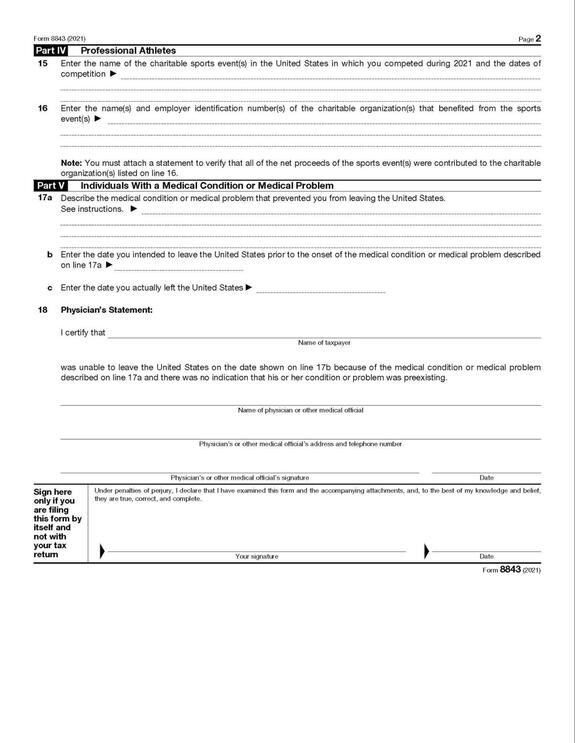

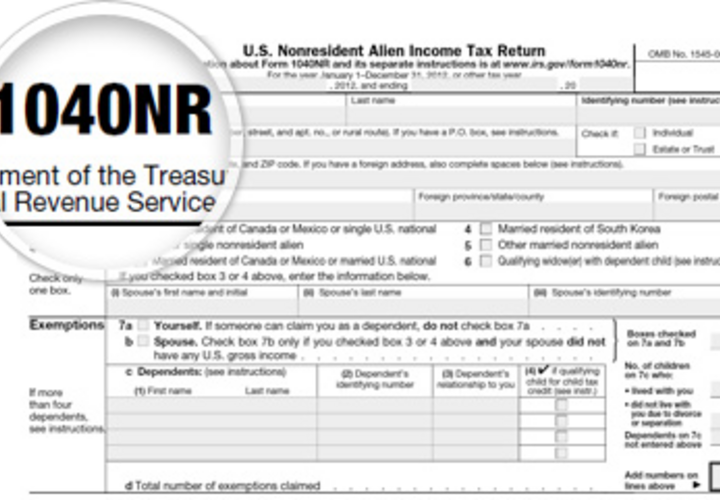

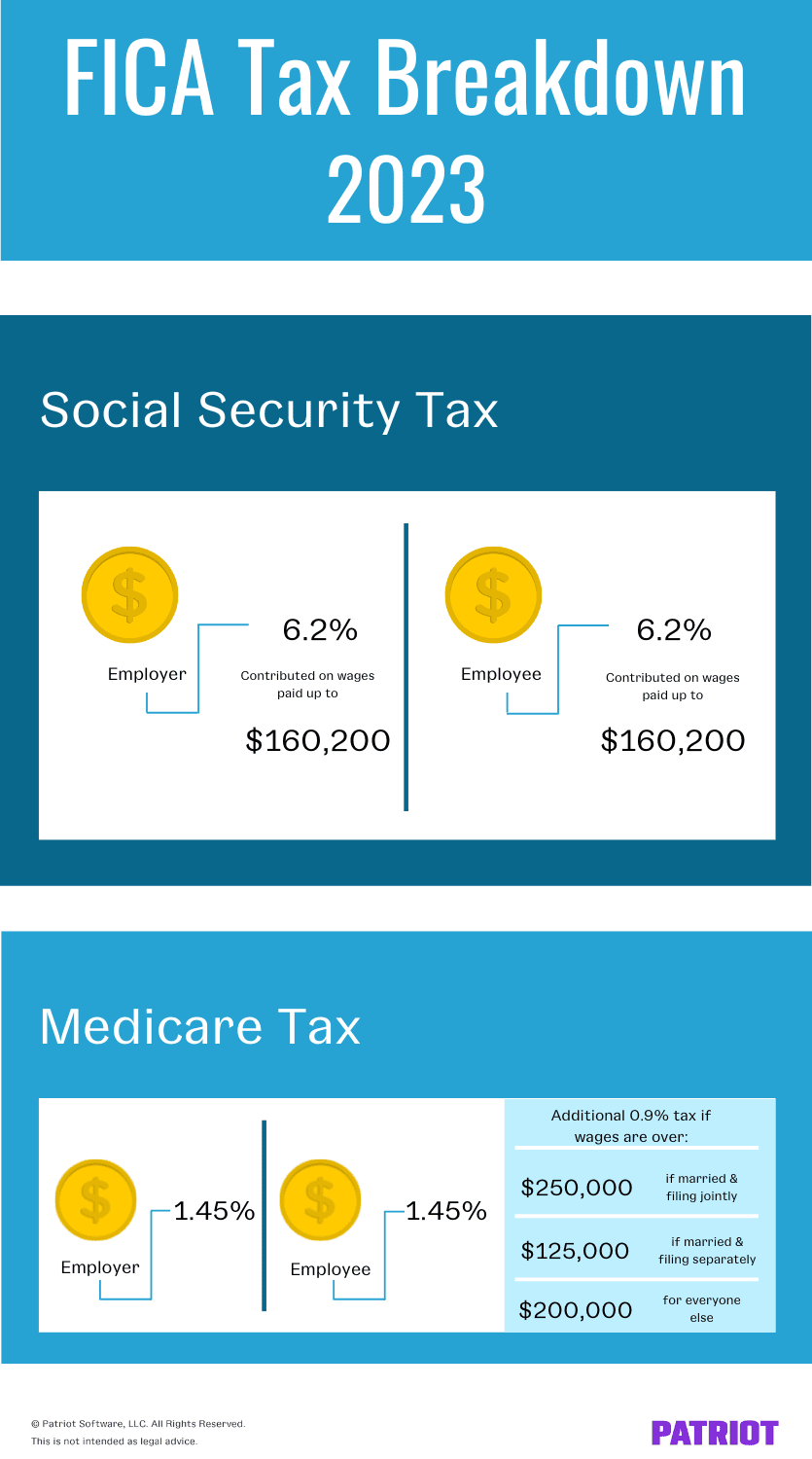

IRS Guideline: Social Security/Medicare and Self-Employment Tax Liability of Foreign Students, Scholars, Teachers, Researchers, and Trainees What is FICA? FICA is the abbreviation of the Federal Insurance Contribution Act. The FICA tax is a United States federal payroll tax administered to both employees and employers to fund Medicare and Social Security. This means that when you…

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com

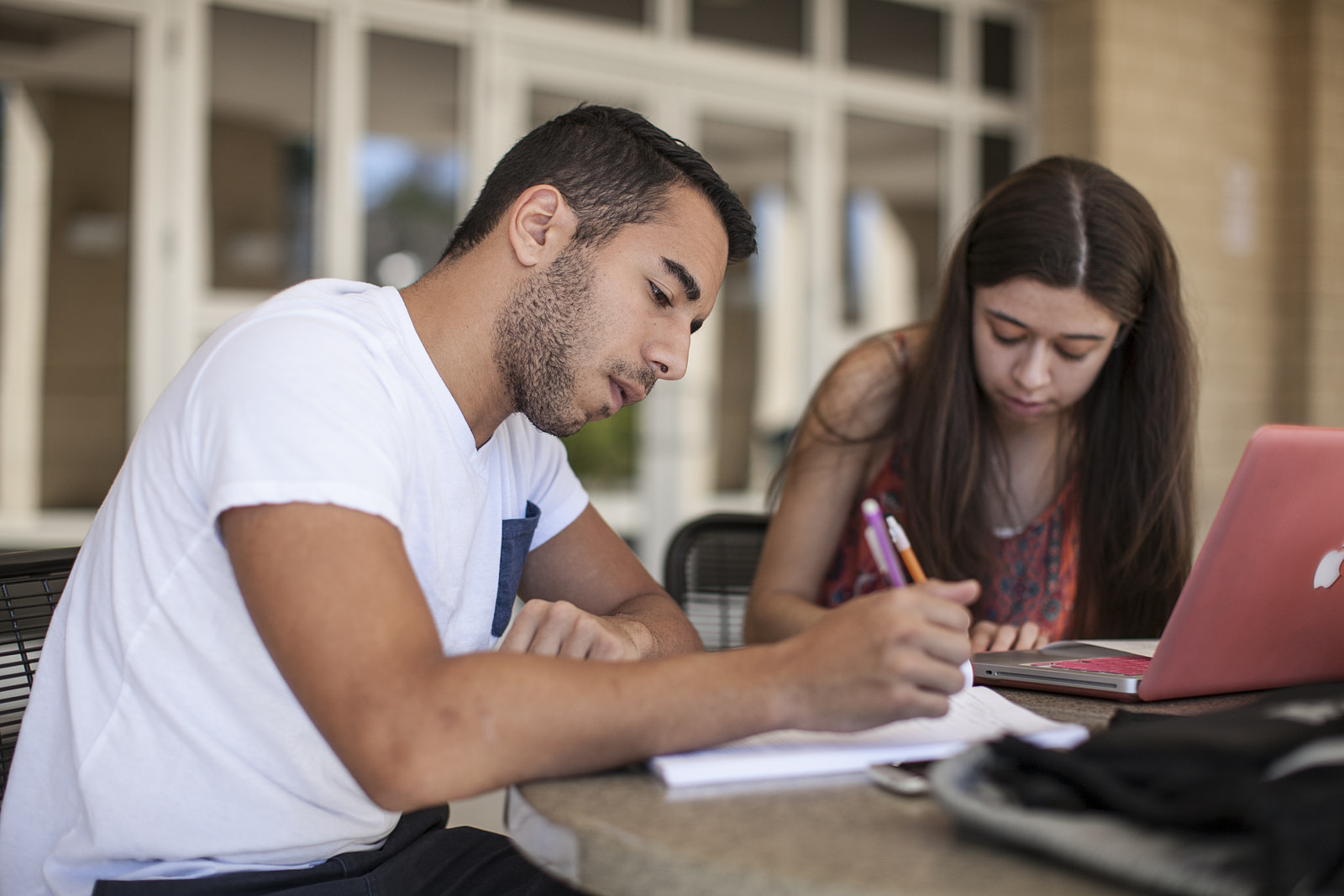

How to Get FICA Tax Refund - F1 Visa, CPT and OPT Students

Maintaining F-1 and J-1 Status - UCF Global

US Tax Return & Filing Guide for International F1 Students [2021

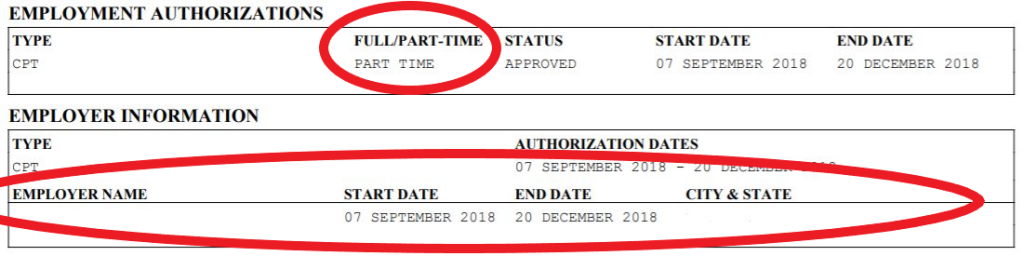

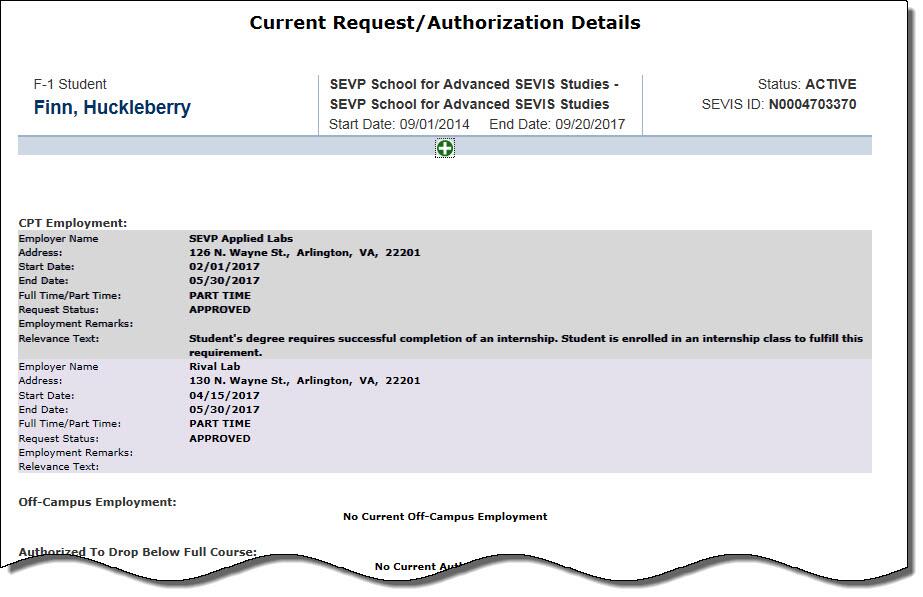

CPT Information for Employers – International Student Services

Electric Vehicle Tax Credits for international students in the US

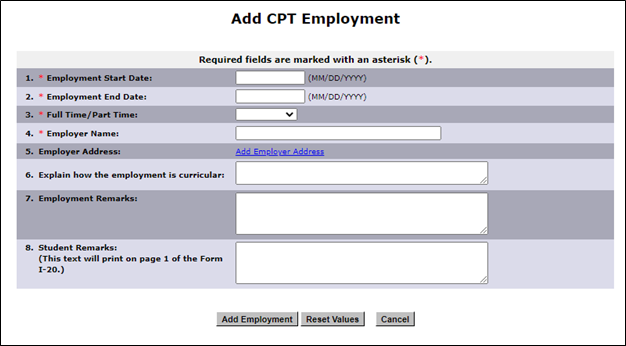

F-1 Curricular Practical Training (CPT)

U.S. Taxes Office of International Students & Scholars

F-1 Curricular Practical Training (CPT)

Everything you need to know about OPT Taxes

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)