Robinhood simplifies investing with new Cash Card and spending

Por um escritor misterioso

Descrição

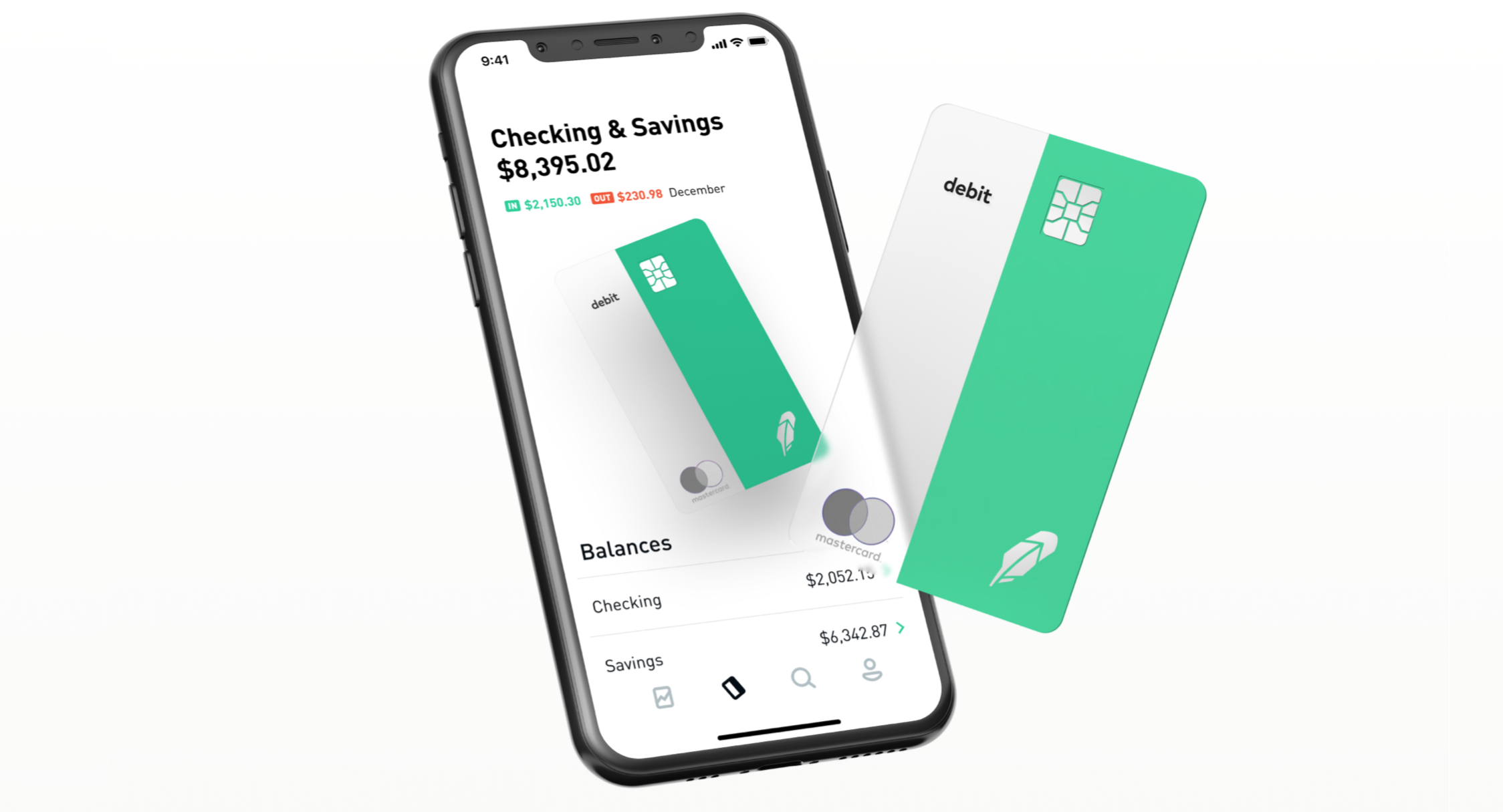

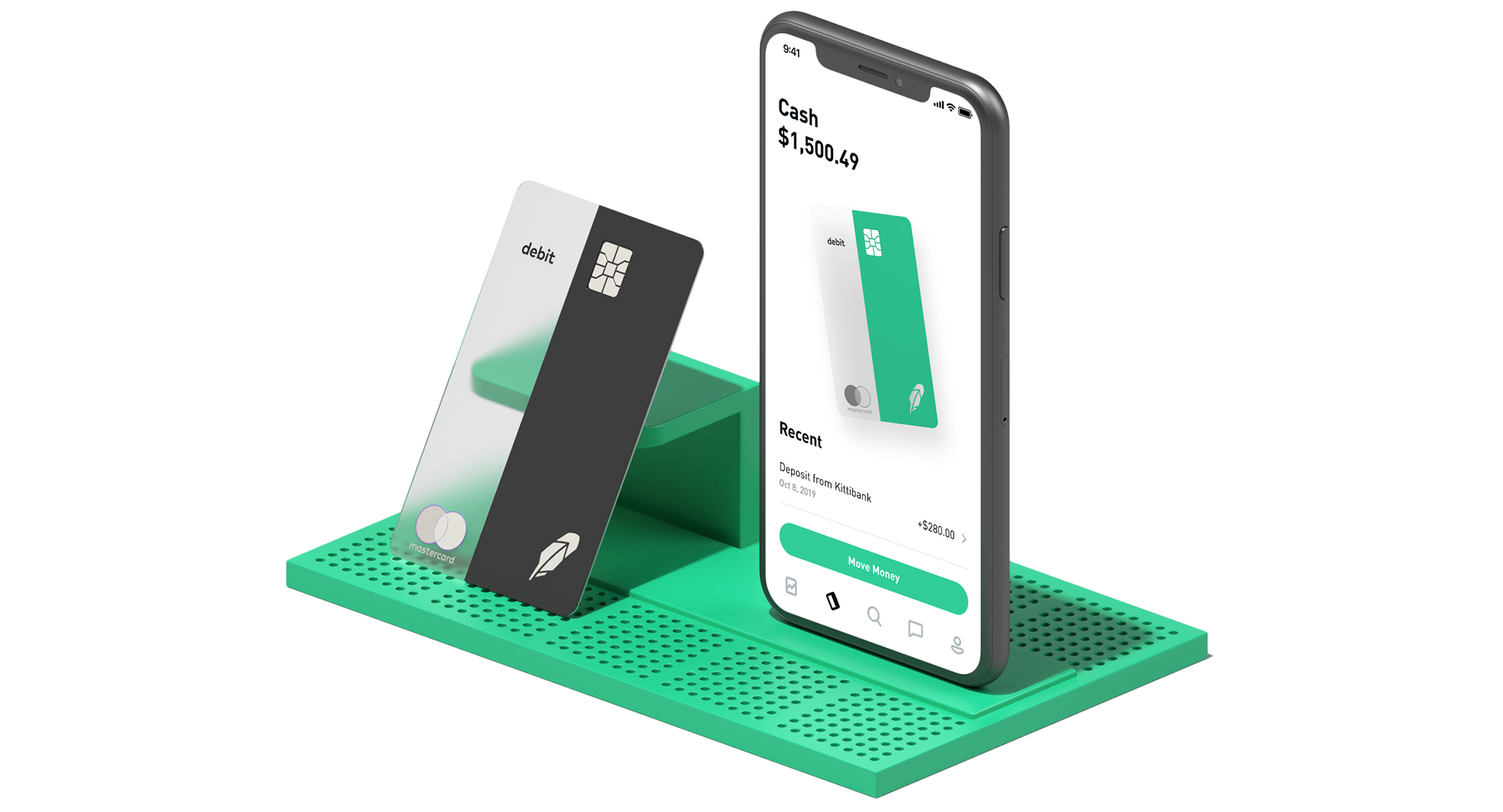

The app-based stock brokerage is phasing out its current debit card and Cash Management program to make investing easier for its clients.

How Does Robinhood Make Money? - FourWeekMBA

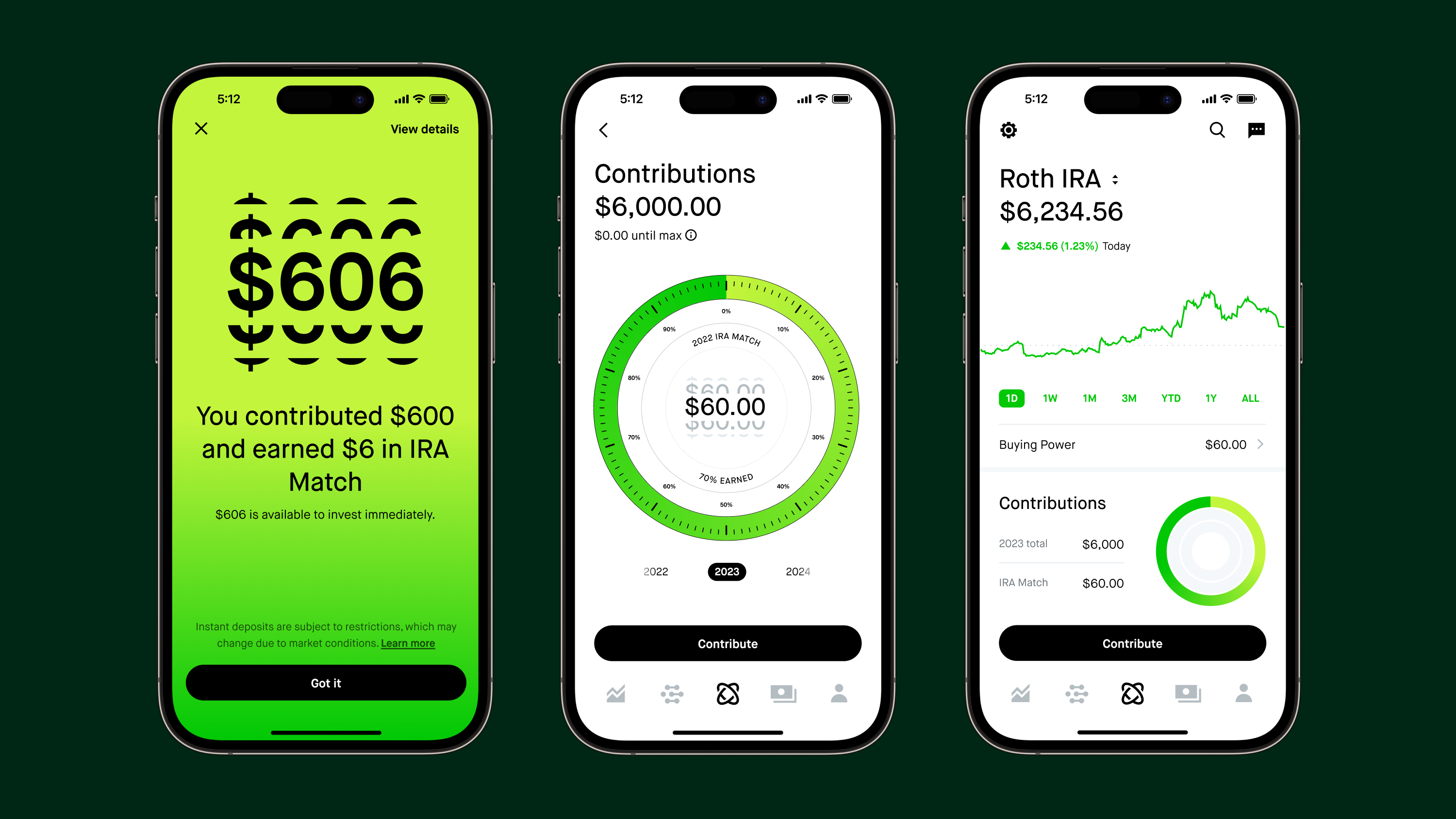

Robinhood Investing: New Retirement Product Will Match 1% of Contributions - Bloomberg

Robinhood launches debit card that lets consumers use spare change to invest

Robinhood launches no-fee checking/savings with Mastercard & the most ATMs

What's the difference between free investing apps like Robinhood and subscription apps like Bloom? Why should I pay when there's a free app already available? - Quora

Robinhood's New Debit Card Turns 'Spare Change' Into Investments

Robinhood revives checking with new debit card & 1.8% interest

Robinhood is still severely limiting trading, customers can only buy one share of GameStop

Best Investing Apps for Beginners [2023]

We did it again. Now earn 4% APY with Robinhood Gold - Robinhood Newsroom

The Robinhood Cash Card Explained (PLUS My Max Rewards Strategy)

Fidelity vs. Robinhood: Which Broker Is Right for You?

de

por adulto (o preço varia de acordo com o tamanho do grupo)